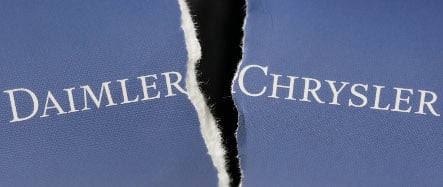

A Daimler AG statement issued in Stuttgart said a deal signed with Chrysler LLC and US pension authorities marks a definitive separation of the German and US firms following a 2007 spin-off to the private equity firm Cerberus.

“Under this agreement, Daimler’s remaining 19.9 percent shareholding in Chrysler will be redeemed and Daimler will forgive repayment of the loans extended to Chrysler, which were already written off in the 2008 financial statements,” the statement said.

Daimler also agreed to pay €600 million in three annual instalments into Chrysler’s pension plans.

In exchange, Chrysler and Cerberus agreed to “waive any claims” against the German group “including the accusations made against Daimler in 2008 that Daimler allegedly improperly managed certain issues in the period between the signing of the agreement and the conclusion of the transaction.”

Daimler bought Chrysler for $36 billion in one of the largest transatlantic mergers of all time, but the deal soured and failed to last a decade.

The new deal with Daimler comes as Chrysler is scrambling to get additional concessions to keep US government emergency aid flowing.

President Barack Obama’s task force has given the Detroit firm until the end of the week to come up with a viable plan to continue providing aid or face bankruptcy court.

Chrysler is seeking to seal an alliance with Fiat to provide new technology and small cars for the US market, which would give the Italian firm a stake in Chrysler without a cash investment.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments