The small rise from 0.9 percent in January on a 12-month basis ran counter to forecasts from analysts polled by Dow Jones Newswires who had expected inflation in the biggest European economy to dip to 0.8 percent.

German inflation had fallen to a 12-month rate of 0.9 percent, its lowest level since February 2004, but UniCredit economist Alexander Koch said Friday that, “the uptick in the headline rate in February is definitely not the end of the downward trend.”

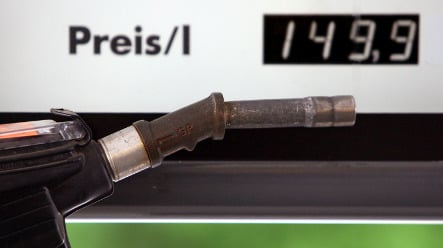

Analysts agree that the sinking oil prices continue to hold the German inflation rate down. “The marked drop in energy prices has again been the main contributor to inflation retreating, and in particular the price of heating oil,” said Commerzbank analyst Simon Juncker.

According to the latest statistics, the fuel prices in six of Germany’s states have dropped by between 12.1 percent and 13.9 percent since February 2008, while the price for heating oil has dropped by as much as 18.4 to 29.4 percent in the same period. But in the past month, there have been contrasting tendencies. While fuel prices have risen by between 0.9 and 1.9 percent, heating oil prices have dropped again by between 5.7 and 11.7 percent.

Across the entire 16-nation eurozone, inflation dropped in January by the sharpest rate on record, slumping to 1.1 percent in the face of a severe economic downturn, according to official EU figures released on Friday.

The fall brought 12-month eurozone inflation to the lowest point since July 1999 and was down sharply from the 1.6 percent that the European Union’s Eurostat data agency recorded in December.

Inflation was expected to fall until July, “when the impact of last summer’s oil price bubble disappears from the year-by-year comparison,” Juncker pointed out.

Capital Economics economist Jennifer McKeown noted that, “as activity in Germany and the eurozone as a whole continues to deteriorate, the European Central Bank should become increasingly worried about the prospect of deflation.”

With inflation now well below the ECB’s target of just under 2.0 percent, “we see the ECB cutting interest rates to zero or very close later this year,” McKeown said.

The ECB has slashed its main interest rate from 4.25 percent to 2.0 percent in four steps since October, and financial markets expect it to reach an all-time low of 1.5 percent when bank governors meet here next week.

Juncker said that with inflation expected to fall briefly into negative territory, there was “scope for more rate cuts in the months ahead.”

Please whitelist us to continue reading.

Please whitelist us to continue reading.