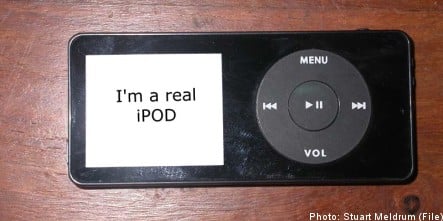

Disappointment set in quickly for many customs employees upon discovering that what they thought were shiny new iPods emblazoned with the Tullverket logo were in fact simply knock-off copies of the popular Apple music players.

“Embarrassing. Our job is the stop the spread of things like this,” one employee told the Aftonbladet newspaper.

Officials from the Swedish Consumer Agency (Konsumentverket) are now looking into whether the gifts may be illegal.

“At first glance, I couldn’t tell the difference from an iPod,” said Consumer Agency lawyer Marek Andersson to Aftonbladet.

“If I’d been a lawyer for the company with the rights, I would have reacted.”

Agency spokesperson Anette Malmberg explained that Tullverket had hired another company to procure the gifts and never would have knowingly distributed illegal knock-off iPods to employees.

“This isn’t something we’ve imported ourselves,” she said.

“We assume that the company which delivered to us did so in the correct manner.”

Now customs employees may have to give back the pirated iPods altogether.

“It’s both embarrassing and ironic that people in our organization don’t have a better understanding of this. One of missions is to hunt down pirated goods,” said another customs employee.

Please whitelist us to continue reading.

Please whitelist us to continue reading.